What is Budgeting?

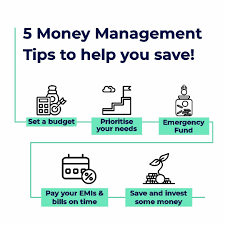

Budgeting is the process of creating a plan for how to spend your money. It involves tracking your income, understanding your expenses, and allocating your funds to cover essential needs, save for the future, and pay off debts. Effective budgeting allows you to live within your means, avoid unnecessary debt, and ensure that you’re putting money aside for savings and long-term goals.

Why Budgeting Matters

Without a budget, it can be easy to overspend, fall into debt, and lose sight of your financial goals. Budgeting helps you control your finances, stay on track with your goals, and make conscious decisions about where your money goes. It also provides peace of mind, knowing that you have a clear financial plan in place.

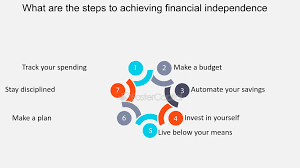

Steps to Create a Budget

- Track Your Income: Start by determining how much money you bring in each month, whether it’s from your salary, business income, or other sources.

- List Your Expenses: Identify both fixed expenses (rent, utilities, loan payments) and variable expenses (groceries, entertainment, dining out).

- Set Savings Goals: Allocate a portion of your income to savings. Financial experts recommend saving at least 20% of your income.

- Review and Adjust: Regularly review your budget and make adjustments as necessary. Life changes, and so should your budget.

2. Understanding Credit and Credit Scores

What is a Credit Score?

A credit score is a numerical representation of your creditworthiness. It reflects your ability to repay borrowed money and indicates the level of risk you pose to lenders. Credit scores range from 300 to 850, with higher scores indicating better creditworthiness.

Why Credit Scores Matter

Lenders use your credit score to decide whether to approve a loan application and what interest rate to offer you. A higher credit score typically results in better loan terms, such as lower interest rates, while a lower score may lead to higher rates or loan rejection.

How to Improve Your Credit Score

- Pay Bills on Time: Your payment history is the largest factor affecting your credit score. Always pay your bills on time to avoid late fees and negative marks on your credit report.

- Reduce Debt: Try to keep your credit utilization ratio (the percentage of your available credit you’re using) under 30%. Paying down credit card balances will help improve your score.

- Check Your Credit Report: Regularly review your credit report for errors or discrepancies that could negatively impact your score.

- Avoid New Debt: Each time you apply for credit, it generates a hard inquiry, which can temporarily lower your score. Be selective about applying for new credit.

3. Debt Management: How to Handle and Eliminate Debt

What is Debt Management?

Debt management involves strategies for reducing or eliminating personal debt. Managing debt is crucial to maintaining financial stability and avoiding financial stress. Unchecked debt can lead to high-interest payments, late fees, and a poor credit score.

The Risks of Debt

Debt can be a double-edged sword. On the one hand, using credit responsibly can help you build a good credit score and enable major purchases like a house or car. On the other hand, excessive debt can lead to financial difficulties, affecting your credit score, causing emotional stress, and preventing you from saving money.

Strategies for Managing Debt

- Create a Repayment Plan: Start by listing all of your debts, including the amount owed, the interest rate, and the monthly payment. This will help you prioritize which debts to pay off first.

- Pay More Than the Minimum: If possible, make extra payments toward high-interest debts to reduce the principal faster. This helps save on interest over time.

- Consolidate Debt: Consider consolidating multiple debts into a single loan with a lower interest rate. Debt consolidation can simplify payments and reduce the total interest paid.

- Avoid Accumulating New Debt: While paying down existing debt, avoid taking on new debt unless absolutely necessary.

4. Building an Emergency Fund

Why You Need an Emergency Fund

An emergency fund is money you set aside to cover unexpected expenses, such as medical bills, car repairs, or job loss. Having an emergency fund prevents you from going into debt when life throws you a financial curveball.

How Much Should You Save?

Financial experts recommend having at least three to six months’ worth of living expenses saved in an emergency fund. This can give you enough time to recover financially if something unexpected happens.

Steps to Build an Emergency Fund

- Set a Savings Goal: Determine how much you need for emergencies and create a savings target.

- Start Small: If you can’t reach your goal right away, start with small contributions. Even $50 to $100 per month can add up over time.

- Use a Separate Account: Keep your emergency fund in a separate, easily accessible savings account, so you’re not tempted to dip into it for non-emergencies.

5. Investing: Growing Your Wealth for the Future

What is Investing?

Investing is the process of allocating money into assets like stocks, bonds, mutual funds, or real estate with the expectation of earning a return. Over time, investments can grow in value, helping you accumulate wealth and achieve your financial goals.

Why Invest?

Investing helps you grow your wealth over time, taking advantage of compound interest and market growth. It also allows you to beat inflation, which erodes the purchasing power of your savings.

Types of Investments

- Stocks: Shares of a company’s ownership. Investing in stocks can provide high returns, but also involves higher risk.

- Bonds: Debt securities issued by governments or corporations. Bonds are generally considered safer than stocks, but they offer lower returns.

- Mutual Funds: A pool of money from various investors used to invest in a diversified portfolio of stocks, bonds, or other securities.

- Real Estate: Investing in property can provide rental income and long-term appreciation.

Risk Management in Investing

Always remember that all investments come with risks, and diversification is key. By spreading your investments across different asset classes, you can reduce the impact of any one asset’s performance on your overall portfolio.

6. Planning for Retirement: Securing Your Future

Why is Retirement Planning Important?

Retirement planning involves saving and investing for the future when you’re no longer working. Planning early ensures you have enough money to maintain your lifestyle in retirement without relying on others or running out of funds.

Retirement Accounts to Consider

- 401(k) or 403(b): Employer-sponsored retirement plans that allow you to contribute pre-tax dollars. Many employers match contributions up to a certain percentage.

- IRA (Individual Retirement Account): A personal retirement account that offers tax advantages for retirement savings.

- Roth IRA: A retirement account where contributions are made with after-tax dollars, and earnings grow tax-free.

The Power of Compound Interest

Starting your retirement savings early allows you to take advantage of compound interest—the process by which the money you earn on your investments also earns money. The longer you invest, the more your wealth can grow.

Conclusion

Understanding personal finance is essential for achieving financial security and success. From budgeting to investing, every aspect of managing your money contributes to your long-term financial well-being. By following the principles outlined in this guide—budgeting wisely, maintaining good credit, managing debt, building an emergency fund, investing for the future, and planning for retirement—you’ll be on the path to financial freedom and peace of mind. Start today, and take control of your financial future!