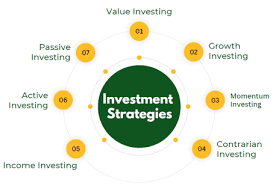

Investing is one of the most powerful tools available to individuals for creating long-term wealth. Whether you’re saving for retirement, a down payment on a house, or just growing your financial resources, strategic investments can significantly impact your financial future. However, investing requires knowledge, patience, and a long-term perspective. In this article, we’ll discuss seven essential investment strategies that can help you build wealth, reduce risk, and achieve your financial goals.

1. Start Early: The Power of Compound Growth

Why Starting Early Matters

The sooner you begin investing, the more time your money has to grow through the power of compounding. Compounding occurs when the returns on your investments start earning their own returns, accelerating the growth of your wealth. The earlier you invest, the greater the impact of compound growth, because you have more time for your money to grow exponentially.

Example of Compound Growth

If you invest $1,000 at an annual return of 7%, after 10 years, your investment will grow to approximately $1,967. However, if you start 10 years later, your $1,000 will only grow to around $1,403 under the same conditions. This demonstrates the importance of starting as early as possible to maximize the benefits of compounding.

How to Start Early

- Automate Contributions: Set up automatic deposits to your investment accounts to ensure that you invest consistently, regardless of market conditions.

- Start Small: Even small amounts can grow over time. Focus on getting started rather than waiting until you can invest a large sum.

- Take Advantage of Tax-Advantaged Accounts: Contribute to retirement accounts like a 401(k) or an IRA to get tax benefits while growing your money.

2. Diversify Your Portfolio: Reduce Risk and Maximize Returns

What is Diversification?

Diversification is the practice of spreading your investments across different asset classes (stocks, bonds, real estate, etc.) to reduce risk. The idea is that by not putting all your eggs in one basket, you are less likely to suffer a significant loss if one investment underperforms. A diversified portfolio allows you to balance risk and increase the potential for positive returns over time.

Types of Diversification

- Asset Class Diversification: Invest in a mix of asset classes, such as stocks, bonds, real estate, and commodities.

- Geographical Diversification: Spread your investments across different regions and countries to protect against local economic downturns.

- Sector Diversification: Invest in different sectors of the economy, such as technology, healthcare, energy, and consumer goods, to avoid concentration risk.

How to Diversify Your Portfolio

- Use Mutual Funds or ETFs: Both mutual funds and ETFs offer built-in diversification by pooling investments into a wide range of stocks or bonds, providing instant exposure to various sectors and asset classes.

- Invest in Index Funds: Index funds track the performance of a market index, such as the S&P 500, offering broad exposure to large companies across different industries.

- Rebalance Regularly: Over time, some investments may outperform others, skewing your asset allocation. Rebalance your portfolio periodically to maintain your desired diversification strategy.

3. Focus on Long-Term Goals: Avoid Short-Term Market Volatility

Why Long-Term Focus is Crucial

One of the most important lessons in investing is the power of long-term thinking. While the stock market can experience significant short-term fluctuations, it has historically delivered positive returns over the long run. Investors who stay focused on long-term goals are less likely to panic during market downturns and more likely to benefit from the growth potential of their investments.

The Risks of Short-Term Thinking

- Emotional Investing: Short-term market movements can trigger emotional reactions, such as fear or greed, causing you to make rash investment decisions that could hurt your portfolio.

- Missed Opportunities: By focusing on short-term gains, you may miss out on long-term growth opportunities, as it takes time for investments to fully appreciate.

How to Stay Focused on Long-Term Goals

- Create a Financial Plan: Define your long-term financial goals, such as retirement or buying a home, and develop an investment strategy that aligns with those objectives.

- Ignore Market Noise: Resist the urge to react to every news headline or market downturn. Stick to your strategy and focus on the bigger picture.

- Use Dollar-Cost Averaging: Invest a fixed amount regularly, regardless of market conditions. This strategy reduces the impact of short-term market volatility by buying more shares when prices are low and fewer when they are high.

4. Reinvest Dividends: Accelerate Wealth Growth

What are Dividends?

Dividends are payments made by companies to their shareholders, typically in the form of cash or additional shares. Dividends are often paid by established companies with a history of profitability. Reinvesting dividends allows you to purchase more shares of the company, further compounding your returns.

Why Reinvesting Dividends Matters

Reinvesting dividends rather than taking them as cash can significantly accelerate the growth of your investment portfolio. This practice enables you to buy more shares, which in turn increases the potential for future dividend payments and capital gains.

How to Reinvest Dividends

- Set Up a Dividend Reinvestment Plan (DRIP): Many companies and brokerage firms offer DRIPs, which automatically reinvest your dividends into additional shares of the stock.

- Choose Dividend-Paying Stocks: Invest in companies with a strong track record of paying dividends and a history of increasing their dividend payouts over time.

- Review Dividend Yields: Look for stocks with reasonable dividend yields and growth potential. Aim for companies that have a balance of stability and growth.

5. Be Mindful of Fees: Minimize Investment Costs

Why Investment Fees Matter

Investment fees, including management fees, trading fees, and expense ratios, can erode your returns over time. Even seemingly small fees can add up significantly, especially over the long term. Minimizing fees is a crucial part of maximizing your investment returns.

Types of Investment Fees

- Management Fees: Fees charged by fund managers for managing mutual funds, ETFs, or other investment vehicles. These fees are typically a percentage of the assets under management (AUM).

- Trading Fees: Fees associated with buying and selling securities. These fees can be charged per trade or as a percentage of the trade value.

- Expense Ratios: The annual fees associated with running a mutual fund or ETF. The expense ratio is typically expressed as a percentage of the fund’s average assets under management.

How to Minimize Fees

- Choose Low-Cost Index Funds and ETFs: These funds have lower management fees and expense ratios compared to actively managed funds.

- Look for Commission-Free Platforms: Some brokerage platforms offer commission-free trading, which can help reduce trading fees.

- Compare Fees Across Investments: Before making an investment, always review the fee structure and choose investments with the lowest costs that align with your goals.

6. Invest in What You Understand: Make Informed Decisions

Why Understanding Your Investments is Key

Investing in assets that you don’t understand can be risky. Without a solid understanding of how your investments work, you may make decisions based on fear or hype, leading to poor outcomes. Educating yourself about your investments is essential for minimizing risk and making informed choices.

How to Make Informed Investment Decisions

- Do Your Research: Take the time to understand the assets you are investing in, including the underlying business models, financials, and potential risks.

- Avoid FOMO (Fear of Missing Out): Just because a stock or investment is trending doesn’t mean it’s a sound investment. Stick to your investment strategy and focus on long-term goals.

- Invest in Familiar Sectors: Invest in industries or companies that you have knowledge of or experience in. This can give you a competitive edge in understanding market trends and risks.

7. Stay Disciplined: Avoid Emotional Investment Decisions

Why Discipline is Important

Emotional investing is one of the most common mistakes investors make. The fear of loss or the excitement of potential gains can lead to rash decisions, such as selling during a market downturn or buying into a bubble. Staying disciplined and sticking to your investment strategy is critical for long-term success.

How to Stay Disciplined

- Set Realistic Expectations: Understand that investments will have ups and downs, and don’t expect to make a quick profit. Patience is key.

- Create a Diversified Portfolio: Having a diversified portfolio helps mitigate risk and prevents emotional reactions to market fluctuations.

- Stick to Your Plan: Avoid making impulsive decisions based on short-term market conditions. Follow your long-term plan and resist the urge to chase quick profits.

Conclusion

Investing wisely is a long-term endeavor that requires patience, discipline, and a well-thought-out strategy. By starting early, diversifying your portfolio, staying focused on long-term goals, reinvesting dividends, minimizing fees, investing in what you understand, and avoiding emotional decisions, you can create a strong foundation for building wealth. Remember, successful investing is not about chasing immediate gains, but about making thoughtful decisions that will benefit you over time. By following these key investment strategies, you can achieve financial growth and work toward securing a prosperous future.