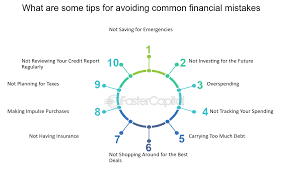

Personal finance is a critical aspect of our everyday lives, yet it is often overlooked or misunderstood. Properly managing your finances can help you achieve financial freedom, secure your future, and navigate life’s unexpected financial challenges. Whether you’re a student, a young professional, or someone who is already well-established, mastering the principles of personal finance is essential.

In this guide, we will walk you through key personal finance concepts, from creating a budget to planning for retirement. Understanding these concepts and implementing them in your life will help you build a strong foundation for financial success.

1. Budgeting: The Key to Financial Control

What is Budgeting?

Budgeting is the process of creating a plan to spend your money. It involves tracking your income and expenses to ensure that you live within your means. A good budget allows you to allocate funds toward necessary expenses, savings, and even discretionary spending without putting yourself into debt.

Why Budgeting is Important

Without a budget, it’s easy to overspend and find yourself in debt. By knowing where your money is going, you can make more informed decisions and ensure that your financial priorities are met. Budgeting helps you avoid financial stress, build an emergency fund, and plan for larger financial goals such as buying a home or paying for your children’s education.

How to Create a Budget

- Track Your Income: Identify all sources of income, including your salary, freelance work, or any side gigs.

- List Your Expenses: Categorize your expenses into fixed costs (rent, utilities, loan payments) and variable costs (groceries, entertainment, dining out).

- Set Financial Goals: Determine how much you want to save each month and any other long-term financial goals (such as paying off debt or building an emergency fund).

- Adjust Your Spending: If your expenses exceed your income, find areas where you can cut back. This could be reducing discretionary spending or finding more affordable alternatives for necessary expenses.

2. Understanding Credit: Building and Maintaining a Strong Credit Score

What is Credit?

Credit refers to the ability to borrow money with the promise to repay it at a later time. It plays a central role in personal finance, affecting your ability to borrow money for big purchases like a home or a car. The most common types of credit include credit cards, loans, and mortgages.

What is a Credit Score?

A credit score is a numerical representation of your creditworthiness, or how likely you are to repay borrowed money. It is based on your financial behavior, including your payment history, credit utilization, and overall debt levels. A credit score typically ranges from 300 to 850, with higher scores indicating better creditworthiness.

Why is Your Credit Score Important?

Your credit score affects your ability to get approved for loans and credit cards, as well as the interest rates you are offered. A higher credit score generally results in lower interest rates, which means you will pay less over time for things like a mortgage or car loan. On the other hand, a lower credit score can result in higher interest rates, making it more expensive to borrow money.

How to Improve Your Credit Score

- Pay Your Bills on Time: Late payments can severely impact your credit score. Make sure to pay all your bills on time, including credit cards, utilities, and loans.

- Keep Credit Card Balances Low: Aim to keep your credit utilization ratio (the amount of credit you’re using versus your total available credit) below 30%. This will positively impact your credit score.

- Avoid Opening Too Many New Accounts: Each time you apply for credit, a hard inquiry is placed on your credit report, which can temporarily lower your score. Only apply for new credit when absolutely necessary.

- Check Your Credit Report for Errors: Regularly review your credit report to ensure there are no errors that could harm your credit score.

3. Debt Management: Strategies for Getting Out of Debt

What is Debt?

Debt occurs when you borrow money that you are obligated to repay, usually with interest. While some forms of debt, such as student loans or mortgages, can be considered “good debt” because they contribute to your long-term financial well-being, high-interest debt—like credit card balances—can become a financial burden if not managed carefully.

Why Debt Management is Crucial

Unmanaged debt can lead to financial stress, poor credit scores, and long-term financial instability. The goal of debt management is to pay off your outstanding balances, minimize interest costs, and free up money for saving and investing.

Debt Management Strategies

- Pay Off High-Interest Debt First: Focus on paying down high-interest debt (like credit card balances) first. This will save you money in interest over time and help you pay off debt faster.

- Consider Debt Consolidation: If you have multiple debts, consolidating them into one loan with a lower interest rate can simplify your payments and potentially lower your monthly interest costs.

- Make More Than the Minimum Payment: Paying only the minimum balance on credit cards or loans can extend the repayment period and result in paying more interest. Paying more than the minimum will help you reduce your debt faster.

- Seek Professional Help if Needed: If your debt is overwhelming, consider working with a financial advisor or a debt counselor to create a manageable repayment plan.

4. Building an Emergency Fund: A Safety Net for Unexpected Expenses

What is an Emergency Fund?

An emergency fund is a savings cushion set aside for unexpected expenses, such as medical bills, car repairs, or job loss. Having an emergency fund allows you to cover these unexpected costs without relying on credit cards or loans.

Why an Emergency Fund is Essential

Life is unpredictable, and emergencies can arise at any time. Without an emergency fund, you may have to resort to borrowing money, which can increase your debt burden. An emergency fund gives you the financial flexibility to handle life’s challenges without compromising your financial goals.

How Much Should You Save?

Most experts recommend saving at least three to six months’ worth of living expenses in your emergency fund. This will provide a sufficient cushion in case of unexpected financial setbacks. If you are just starting out, aim for a smaller goal, such as $1,000, and gradually build from there.

How to Build an Emergency Fund

- Set a Goal: Determine how much you need to save for emergencies and break that goal into smaller, manageable targets.

- Automate Savings: Set up automatic transfers from your checking account to your emergency fund savings account. This makes saving easier and ensures that you are consistently building your fund.

- Keep it Separate: Store your emergency fund in a separate, easily accessible account, like a high-yield savings account, so you are less tempted to dip into it for non-emergencies.

5. Investing: Making Your Money Work for You

What is Investing?

Investing involves allocating money into assets, such as stocks, bonds, or real estate, with the expectation that it will grow in value over time. Unlike saving, which is about setting money aside for future use, investing allows your money to potentially generate a return and outpace inflation.

Why Investing is Important

Investing allows you to grow your wealth over time. While savings accounts offer minimal returns, investments like stocks and bonds have the potential for higher returns. Additionally, investing helps protect your wealth from inflation, which decreases the purchasing power of money over time.

Types of Investments

- Stocks: Equities that represent ownership in a company. Stocks can offer high returns but come with higher risk.

- Bonds: Debt securities issued by companies or governments. Bonds are generally considered safer than stocks, but they offer lower returns.

- Mutual Funds and ETFs: Investment vehicles that pool money from many investors to invest in a diversified portfolio of stocks, bonds, or other assets.

- Real Estate: Purchasing property for rental income or capital appreciation.

Risk Management in Investing

Investing always involves risk. To manage risk, it’s important to diversify your investments. By spreading your investments across different types of assets, you can reduce the impact of any one asset’s performance on your overall portfolio.

6. Retirement Planning: Securing Your Future

Why is Retirement Planning Important?

Retirement planning is the process of saving and investing for the period of your life when you are no longer working. Starting early is key, as the longer you save, the more your investments will have time to grow. Planning for retirement ensures that you’ll have enough money to live comfortably in your later years.

Retirement Accounts to Consider

- 401(k): An employer-sponsored retirement account that allows you to contribute pre-tax money. Many employers offer matching contributions.

- IRA (Individual Retirement Account): A personal retirement account that provides tax advantages. There are two types: traditional (tax-deferred) and Roth (tax-free).

- Roth IRA: Contributions are made with after-tax dollars, but earnings grow tax-free.

How Much Should You Save for Retirement?

Experts recommend saving at least 15% of your income each year for retirement. If you start saving early, you may be able to save less each month and still reach your retirement goals. The key is consistency and starting as early as possible.

Conclusion

Mastering personal finance is an ongoing process, but it’s essential for achieving financial stability and long-term wealth. By understanding and applying the concepts of budgeting, credit management, debt reduction, saving, investing, and retirement planning, you can take control of your financial future and build a solid foundation for financial success. Start today by taking small steps, and over time, you will see significant improvements in your financial life.